Vertex Edge: A "Unichain for Perps"

Liquidity in DeFi stands at a crossroads. Perpetuals trading continues to rapidly gain momentum across both layer one and layer two networks. However, liquidity fragmentation across chains remains a significant challenge, creating disadvantages for both traders and liquidity providers.

Solving the persistent issue of liquidity fragmentation is key to unleashing DeFi’s full potential. In response, several notable innovations have emerged, most recently with the introduction of Uniswap’s Unichain L2.

Unichain is designed to aggregate liquidity across multiple chains, enhancing trading efficiency by reducing transaction costs and latency — all while offering a scalable, accessible layer two solution for multi-chain swaps. The onset of Unichain mirrors the broader ambitions of Vertex Edge, which comparatively focuses on a multi-chain orderbook for perpetuals.

Despite differences in execution, both platforms share a common vision: to revolutionize trading across chains, ensuring seamless liquidity and delivering an exceptional trading experience.

Both approaches aim to mend the fractured liquidity landscape, but each takes a different path to get there.

The Liquidity Conundrum in DeFi

Layer 2 scaling solutions and emerging Layer 1 app chains have indeed slashed fees and sped up transactions. But those inherent advantages of a thriving ecosystem populated by an array of new base layers comes at the expense of liquidity.

Liquidity ends up scattered across various ecosystems like shards of glass, each reflecting only a fragment of the broader industry’s activity. Fragmentation often breeds inefficiencies, igniting fierce competition among chains vying for a slice of the available liquidity providers.

The resulting PVP environment of this high-stakes arena leaves users struggling as they attempt to navigate a fractured state of zero-sum games where, all too often, they end up paying the price.

Unichain’s strategy is to weave together the liquidity threads of multiple chains, leveraging the Optimism Superchain to create a cohesive whole for swaps. With single-block, cross-chain messaging, Unichain allows traders to interact with multiple ecosystems as if they were operating on a single chain. It transforms DeFi into a seamless experience — a tapestry where every thread of liquidity finds its place on a single L2.

The Vertex Edge approach is quite similar to that of Unichain, albeit different in scope.

Both models promote unified liquidity beyond the confines of siloed ecosystems, but their differences lie in Vertex Edge’s emphasis on a unified liquidity model for perpetuals, in contrast to Unichain’s focus on multi-chain swaps.

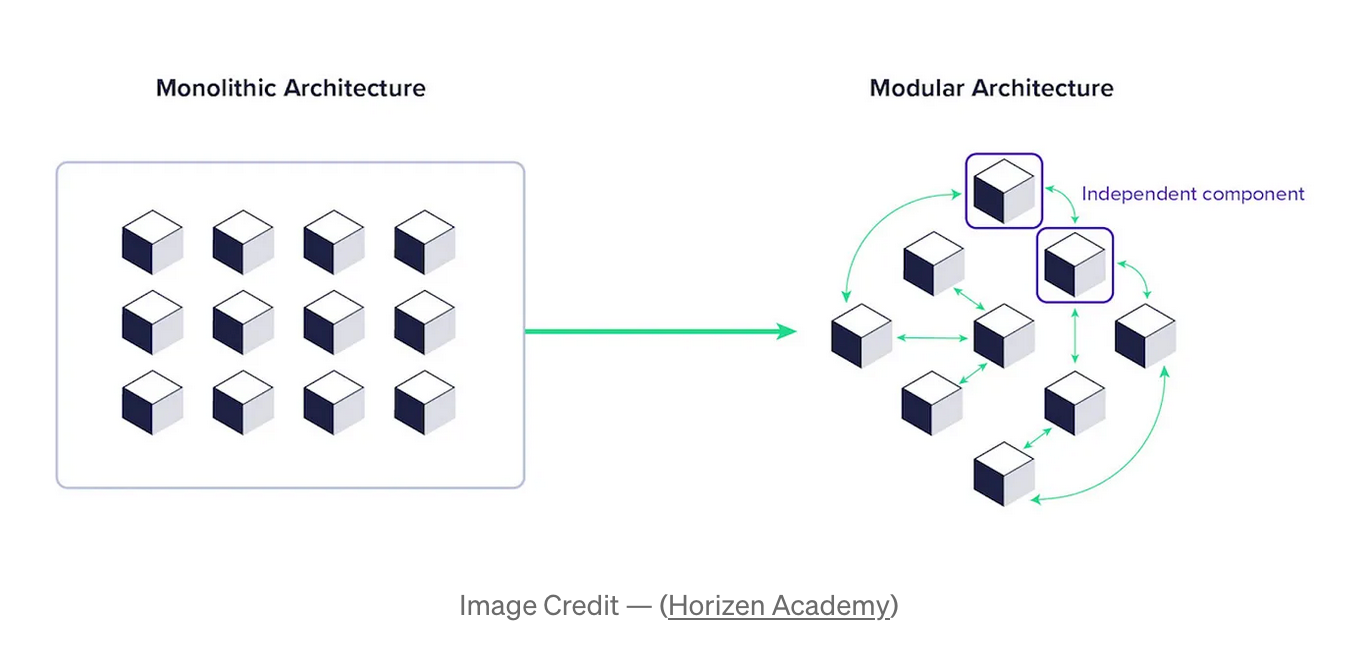

Monoliths & App Chains — The Pitfalls of Perps Isolation

Perpetual markets have historically faced significant challenges in achieving liquidity aggregation, particularly when compared to spot markets. While spot liquidity can be disaggregated across new chains and platforms — such as native AMMs springing up on every new chain — perpetual markets are inherently more complex.

Perpetuals typically require either orderbook or bespoke pool structures, which are harder to establish and maintain across chains.

The issue is exacerbated by the fact that many L1s are built with general-purpose functionality in mind, something that’s not easily accommodated by the nuanced requirements of perpetuals trading.

Recent trends highlight a notable shift toward L1 app chains dedicated to specific functions (e.g., performant trading), signaling a retreat to localized scaling solutions.

While the benefits of the monolithic approach are readily apparent, L1 app chains often suffer from a self-imposed exile. Confining liquidity and users to an application-specific chain ultimately erodes the advantages of composability with the broader market — further fragmenting the user experience by siloing liquidity into isolated chains.

Even within interoperable network standards between app chains, such as IBC on Cosmos, users still face complex wallet journeys to bridge the gap between an app on one IBC-enabled chain and another.

The appeal of the L1 app chain model for perps is its ability to concentrate local liquidity. However, it fundamentally conflicts with the broader demands of cross-chain liquidity and market scalability.

For example, the perpetual app chain model is analogous to opening a series of exclusive neighborhood banks. While these banks serve their local customers well, they form barriers for anyone trying to access capital from other neighborhoods — elevating the difficulty of moving funds between locations. It’s inherently restrictive by design.

In the long-run, inadvertently creating ecosystems that are closed off from the broader DeFi world is a problem compounded by a necessity to scale both economic and technical security costs in parallel with an app’s product innovation.

The assumption that any reasonably successful app needs to launch its own chain is more of the exception than the rule. While applicable in unique cases with flagship brands like Uniswap and Unichain, different products require different assumptions — such as perps.

App chains built around perpetuals often resemble attempts to turn a company into a self-sustaining nation. They face the steep costs of securing their network, such as validator rewards, while also having to attract and grow a loyal user base.

At the same time, they must navigate the challenge of remaining profitable, balancing the demands of security, user acquisition, and financial sustainability. Typically this dynamic manifests as a significant trade-off in either decentralization or security mechanisms — or both.

It’s a story nearly as old as the industry itself, evident in the graveyard of chains throughout crypto’s history. And if crypto has taught us anything, the pitfalls of rolling your own consensus ranks among the most unforgettable lessons.

Vertex: The Cutting Edge Of Multi-Chain Perpetuals

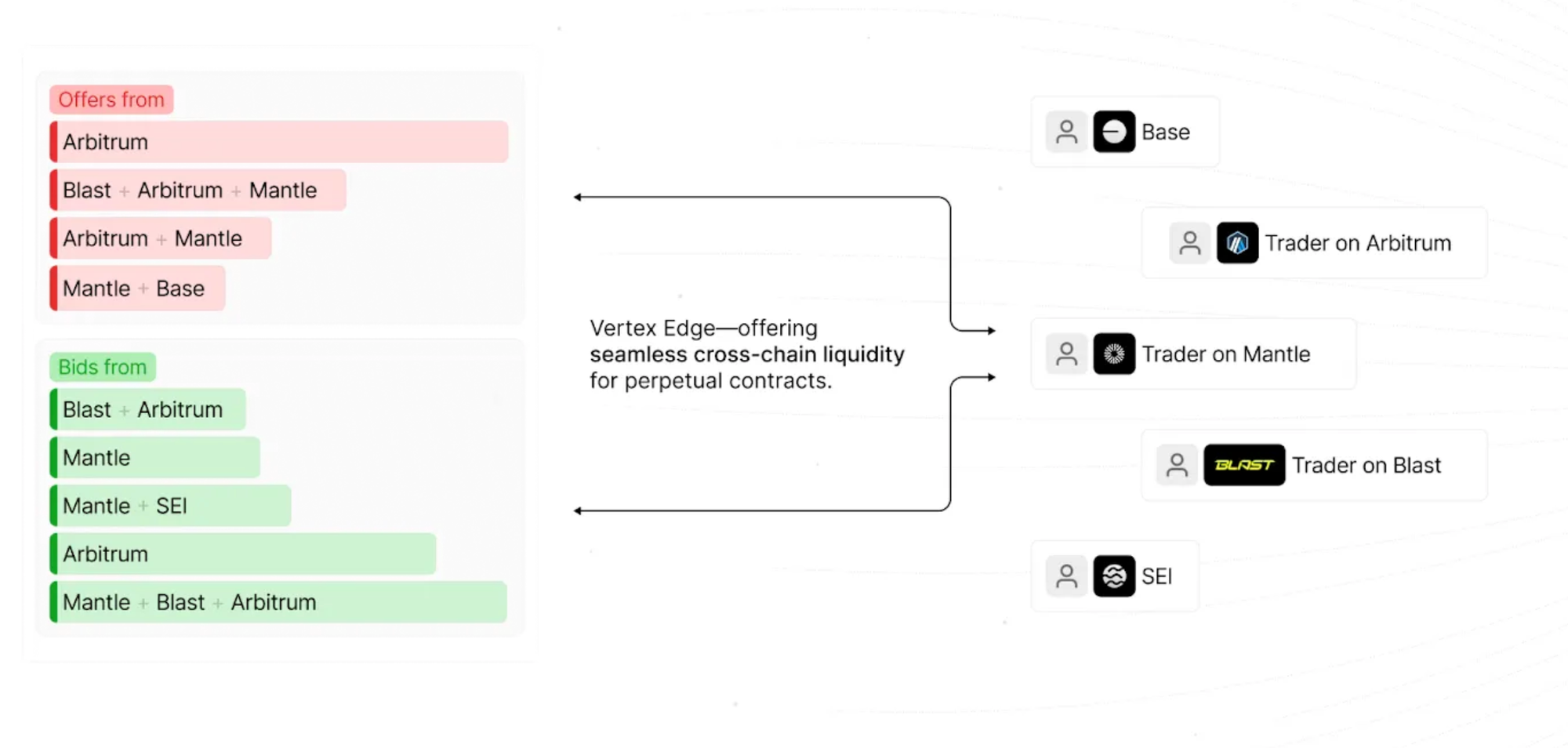

By contrast, Vertex Edge’s multi-chain approach unifies perpetual liquidity in a way that supports seamless interaction across multiple L1 and L2 chains.

Edge breaks free from the isolation characteristic of monolithic designs. By pooling liquidity from various chains, it offers traders access to deeper liquidity without the hassle of bridging or the constraints of single-chain architecture.

The technical architecture carefully strikes a balance between performance and the inherited security of the underlying chain. Multichain liquidity aggregation means that liquidity providers can serve multiple chains without being confined to one, thereby avoiding bottlenecks and enhancing transaction throughput.

In short, Edge is fast, liquid, and composable all without sacrificing the underlying chain’s security by converting to a monolithic design.

Near-instantaneous order matching is paired with on-chain settlement that scales between multiple chains concurrently. Relying on the inherited security of the underlying chain, this model contrasts with more centralized monolithic systems that prioritize performance at the expense of user sovereignty, security, and self-custody.

Incentive alignment between app and base layer is ossified as the growth of Edge produces a net positive impact on the blockspace demand of the underlying chain — a function of its trading activity settled to that chain.

By ensuring that users can trade across chains without relying on slow bridges or inefficient cross-chain messaging characteristic of app chains, Vertex Edge creates a fluid and efficient trading environment.

Furthermore, Vertex Edge’s model positions it as a white-label solution for other L1 and L2 brands, meaning that other projects can launch on various chains without needing to build from scratch.

One example is Pear Protocol, which uses Vertex on Arbitrum to facilitate cross-margined pairs trading. Vertex brings 50+ highly liquid perpetual markets to Pear users, allowing hundreds of possible trading combinations on Pear Protocol.

Edge not only speeds up DeFi adoption but also allows liquidity providers to focus on market-making rather than infrastructure concerns, leading to a more efficient and decentralized DeFi market.

The Horizon: Perpetuals Without Borders

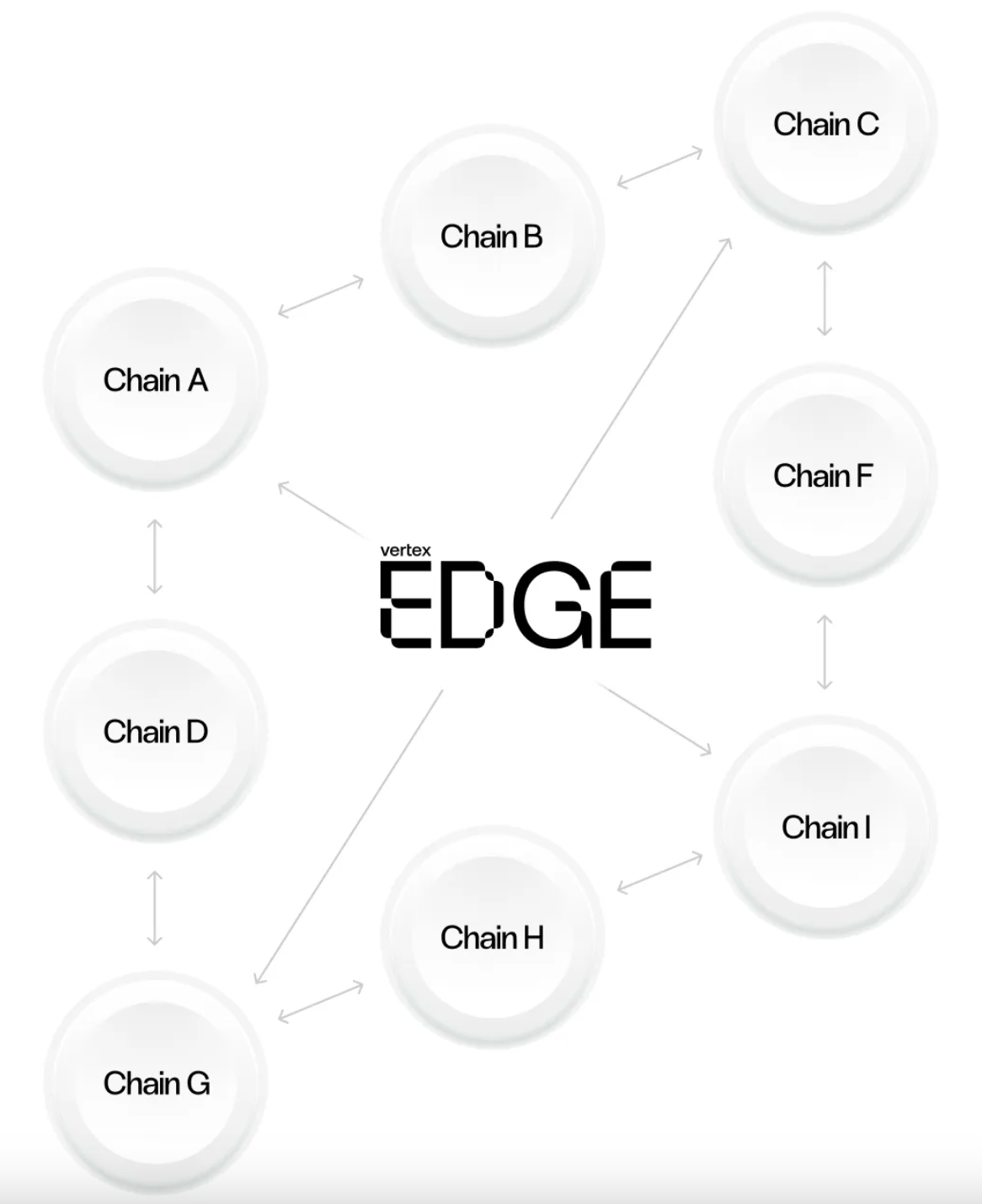

Deployed natively on each chain where it exists, Vertex Edge presents users with a network of synchronous orderbook exchanges.

Order matching and settlement move from one chain to many, ushering in the convenience of users trading against the aggregate liquidity of multiple chains instead of switching networks, bridging assets, and interacting with a new UI on a different network.

Rather than waiting for users to conform to a single chain, Edge meets them wherever they choose to trade — like a bridge that spans across shifting rivers.

Vertex comes to you, anon.

To quote our favorite developer from his basement dungeon:

“Edge is the only multi-chain perp exchange that is aligned with every chain that it is built on. Trades settle to each chain independently, and activity on Edge is activity on the underlying chains.”

Thanks to a single orderbook between chains, Edge fosters blockspace demand and liquidity flow native to whatever chain is plugged into its sequencer. Liquidity providers can finally serve traders across multiple chains without being trapped by the limiting factor of chain fragmentation.

If Unichain positions itself as the diplomat of DeFi, bringing together disparate nations of liquidity, Vertex Edge is the skilled artisan, crafting a bespoke solution for perpetual futures.

Its multichain architecture simplifies the trading process, enabling cross-chain liquidity without the thorny complications of bridging.

As Edge integrates with more blockchains, its network of liquidity expands, promising traders a broader horizon — one where every new chain is an opportunity, not an obstacle.

Both Unichain and Vertex Edge target DeFi’s liquidity dilemma, but their strategies differ sharply. Unichain’s ambition is a universal DeFi experience, while Vertex Edge hones in on perpetuals with the exacting precision of a master craftsman, carving through the complexities of cross-chain liquidity like a scalpel.

As the demand for frictionless liquidity grows, Edge’s vision of seamless multi-chain integration invokes a dynamic force in the evolution of perpetuals trading — transforming not just how trades happen, but where the very lines of liquidity are drawn.

Let the anons trade. And let them do it from their favorite chain.

The Vertex way.

About Vertex

Vertex was founded by a team of seasoned traders and engineers from both traditional finance and DeFi markets. Recognizing the need for more flexible DeFi trading, Vertex launched on Arbitrum and now is proud to play a role in the innovation of a multi-chain DeFi ecosystem.