Market Making with Elixir: Revolutionizing Orderbook Liquidity

Market-making plays a vital role in the world of cryptocurrency.

Liquidity on centralized exchanges relies heavily on a handful of firms deploying algorithms to narrow the bid-ask spreads of markets and ensure deep orderbook liquidity. But market-making is a complex endeavor, isolated to a select few of sophisticated professionals.

Moreover, the crypto industry has been dominated by a small number of centralized players for years, especially on the maker side of the orderbook. Projects with native tokens are often left with limited options to access liquidity, driven by high barriers to entry on CEXs and less efficient exchange alternatives with pool-based DEXs.

Not anymore.

Vertex is pleased to welcome a paradigm shift with the upcoming Elixir unveiling of Fusion Pools. Soon, everyone can become a market-maker on Vertex with a few simple clicks.

Elixir: The Future of Orderbook Liquidity

A groundbreaking decentralized protocol that revolutionizes market-making, Elixir brings open participation, transparency, and trust-minimized systems to market-making on Vertex. No longer controlled by a localized group of professional trading firms, Elixir’s integration with Vertex unlocks the power of many – markets for the people, by the people. No barriers to entry, just opportunities.

Elixir’s breakthrough concept provides algorithmic liquidity on central-limit orderbooks by deploying the collective capital of retail users in a delta-neutral model. It wields the orderbook equivalent of Uniswap’s famed x * y= k curve to accumulate liquidity and tighten the bid-ask spread of trading pairs on the orderbook. Aggregated LP liquidity is deployed to market pairs on the orderbook, concentrating on a tight band around the market price.

Better market depth results, and LPs receive a familiar risk/return profile to conventional AMMs. Put simply, Elixir blends the extremely popular passive LP of AMMs with the benefits and delta-neutral returns of market-making on an orderbook.

Retail users can simultaneously deploy liquidity across both decentralized exchanges (DEXs) and centralized exchanges (CEXs) with unparalleled ease, simply by depositing USDC into a pool for each perp pair on the whitelabled Vertex liquidity management page:

Elixir empowers projects to obtain superior market-making services for their exchange pairs by aligning incentives and introducing complete transparency. Costs are significantly reduced, and projects gain full visibility into their liquidity provision.

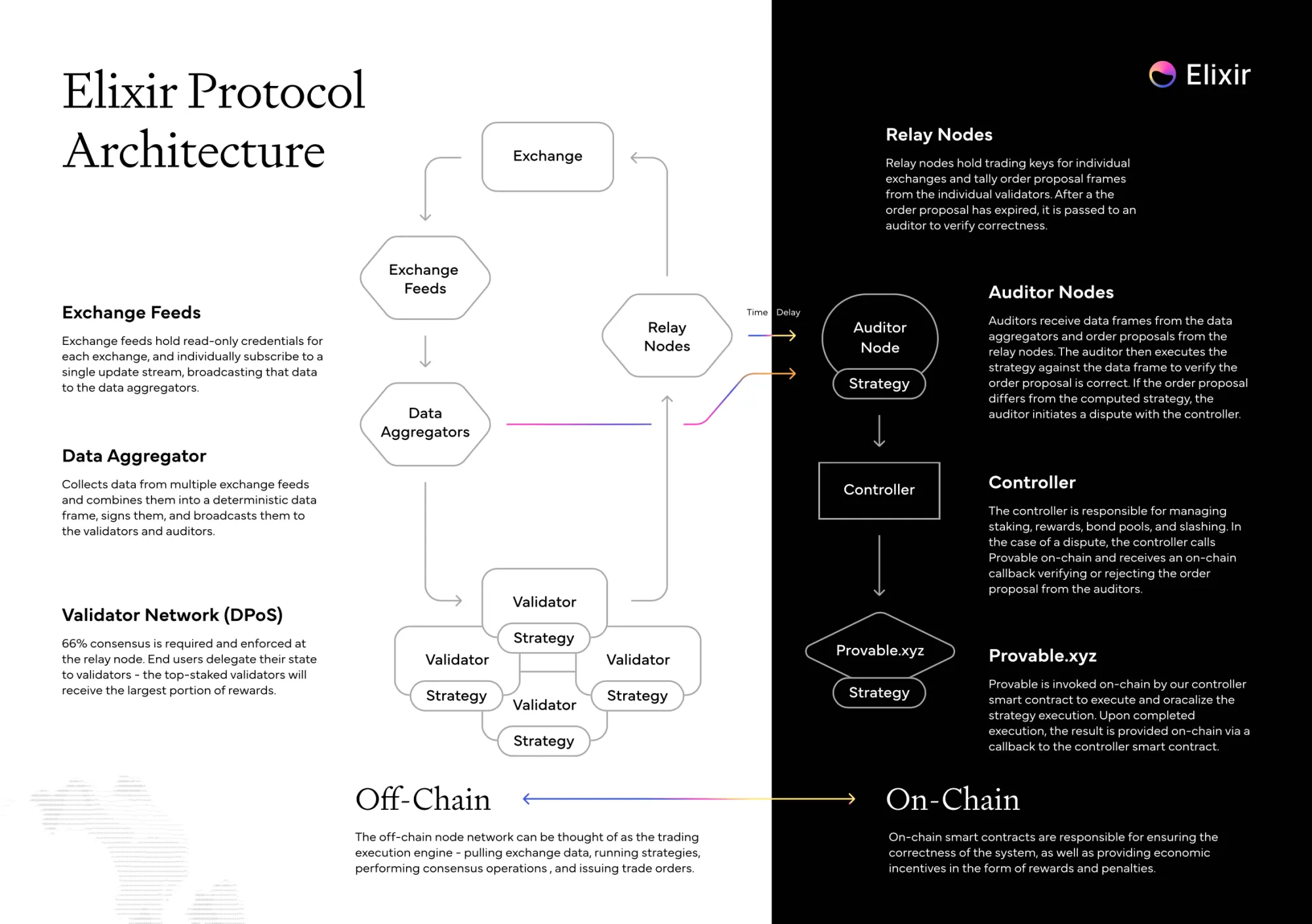

Elixir’s Infrastructure

Elixir boasts a decentralized and high-throughput infrastructure that forms the backbone of its platform. The design ensures that consensus is achieved for every single order made on an exchange.

In terms of security, Elixir adopts an optimistic model similar to Arbitrum, where fraud proofs are posted on-chain on the Ethereum mainnet. This ensures transparency and enhances the overall accessibility of the Elixir system. Elixir’s protocol and vault contracts on Vertex are fully audited by Trail of Bits.

A decentralized architecture and innovative security measures set the stage for a new era of liquidity provision and market-making on Vertex.

Elixir’s contracts are integrated into the Vertex back-end, and the option to LP Fusion Pools on the front-end are presented to users in a few intuitive steps.

Vertex users opting to LP specific Fusion Pools add liquidity to the orderbook in return for yields from the Elixir algorithm generating market-making (e.g., delta neutral) returns on the back-end. Significant uptake of Elixir pools will play a crucial role in reducing slippage, tightening bid-ask spreads, and ultimately minimizing volatility of the supported markets on Vertex.

In summary:

- LP capital → Fusion Pools (orderbook pairs on Vertex)

- Pooled LP capital from Fusion Pools → algorithmic market-making the trading pair on the Vertex orderbook.

- Yield generated from market-making and exchange rewards → distributed pro-rata to LPs.

- More LP capital → tighter spreads and deeper liquidity per market.

Decentralized Participation

Want to become a market maker on Vertex? Here is how you can participate:

- Navigate to Vertex Fusion Pools on Elixir (either via Elixir’s front-end or via links on Vertex’s front-end), here you will find the various pools available to supply liquidity too

- Spot Pools require a 50/50 split of base assets

- Perp Pools require USDC.e as collateral

- Deposit into your chosen pool and receive an ELP token, representing your liquidity in the pool. You can track your ELP's value and see their rewards on the Elixir dashboard at all times. You can also track the market making for each pair here.

- You can redeem ELP tokens at any time, withdrawing your collateral and any rewards earned during provision.

Become a Market Maker, Reap the Rewards

The Vertex Maker Program recognizes dedicated market makers who contribute over 0.25% of maker volume within a specific epoch. All Elixir volume cumulatively counts towards this threshold.

As a maker, you'll enjoy two benefits:

- Fee Rebates

- Tokens

Fee rebates help maximize profits while gaining access to an exclusive percentage of VRTX tokens earmarked for makers participating in Fusion Pools. The incentives align the Vertex community and user base while simultaneously working to onboard greater liquidity to the platform. A more efficient trading environment benefits all Vertex users, and pushes the DEX towards its goal of disrupting the centralized exchange space.