Making Sense of Margin - Understanding the Terms on Vertex

This blog post will aim to explain concepts of cross-margin trading and how it relates to Vertex. It will also cover the terms used across the Vertex app - found at the bottom.

Introduction

Exchanges bring together buyers and sellers. A quality exchange should make it easy and efficient for participants to express their views on the market, while also managing risk. Vertex was built with users in mind, adopting an approach that prioritized speed, fees and capital efficiency when designing the exchange’s matching and risk engine

From a trader’s perspective, Vertex offers a unique product to DeFi users. Low latency and fees make it competitive with CEXs and class-leading compared to other DEXs. A native cross-margin framework gives capital efficiency that is unavailable elsewhere – allowing traders to take advantage of unique strategies previously impossible on one decentralized platform.

- What is cross-margin? It is when an account’s margin is shared across positions. Unlike isolated margin, a cross-margin account can utilize multiple forms of collateral at once and can be automatically utilized by positions to meet margin requirements.

- How does cross-margin benefit traders? Cross-margin provides traders with greater flexibility and capital efficiency through:

- Position offsetting - losing position’s risk can be mitigated by winning positions.

- Multiple Collaterals - Traders can use various collateral as margin for their positions. Traders can maintain spot and LP positions while trading perps without selling their assets for cash/stables.

- Diverse trading strategies & management - such as delta-neutral spread trading to collect funding and LP’ing are vastly simplified under unified cross-margin

Let’s compare some examples.

Now that we understand the principles of cross-margin, how it can benefit traders, and what it means for your Vertex account, let’s examine how Vertex operates under the hood to ensure the safety of all participants.

Determining Collateral & Margin Requirements - Initial & Maintenance Weights

A margin trading account can have assets, such as collateral, and liabilities, such as perp positions. Assets have a positive (+) impact on margin, contributing to the margin an account has for trading and maintaining positions. Conversely, liabilities have a negative (-) impact on margin, reducing the margin an account has available.

Weighted formulas (see next section) are used to value collateral and determine the requirements for liabilities. Weights are based on the risk profile (e.g., historical volatility and liquidity) of an asset to mitigate the effects of sudden changes in price.

For an exchange that only accepts dollar-pegged collateral, collateral is typically weighted at face value. In a cross-margin system, accepting multiple forms of collateral, weights are used to discount collaterals that are more volatile --. (ie USDC or USDT is much more highly weighted than DOGE!). Whether isolated or cross-margined, most trading venues will use 2 weights - ‘Initial’ and ‘Maintenance’.

On Vertex, the initial and maintenance-weighted account values give traders an idea of their account’s health through two metrics; its ability to trade and how close it is to liquidation.

- Initial weight - is used to determine the amount of collateral an account has to initiate new positions, and conversely, the margin required before initiating a new position (hence the term initial). The net initial weighted value of collateral and liabilities provides us with the funds an account has available for trading, also known as initial margin/health.

Applicable example: initial weighted value of collateral - initial weighted value of liabilities = the funds available to trade with (initial margin). If $0, then no new positions can be opened.

- Maintenance Weight - is used to determine the margin required to maintain a (or multiple) position - i.e. to avoid liquidation. The net maintenance-weighted value of collateral and liabilities gives us the funds an account has before it’s eligible for liquidation, also known as maintenance margin/health.

Applicable example: maint. weighted value of collateral - maint. weighted value of liabilities = the funds (initial margin). $0 = liquidation.

The initial weight will always be less than the maintenance weight. Because of this, there is a safety period between when an account can no longer initiate positions (no initial margin left), and can get liquidated. Unifying an account’s margin under two weights - Initial and Maintenance Health - allows Vertex to accept a range of tokens as collateral and to combine that with flexible margining for all open perp positions. Ultimately this flexibility results in greater capital efficiency for users and safer operation for the exchange.

Vertex’s Weights & Calculations

On Vertex, an account can have a variety of assets and liabilities:

- Assets: deposits, positive unsettled PnL, LP Positions

- Liabilities: borrows, negative unsettled PnL, perp positions

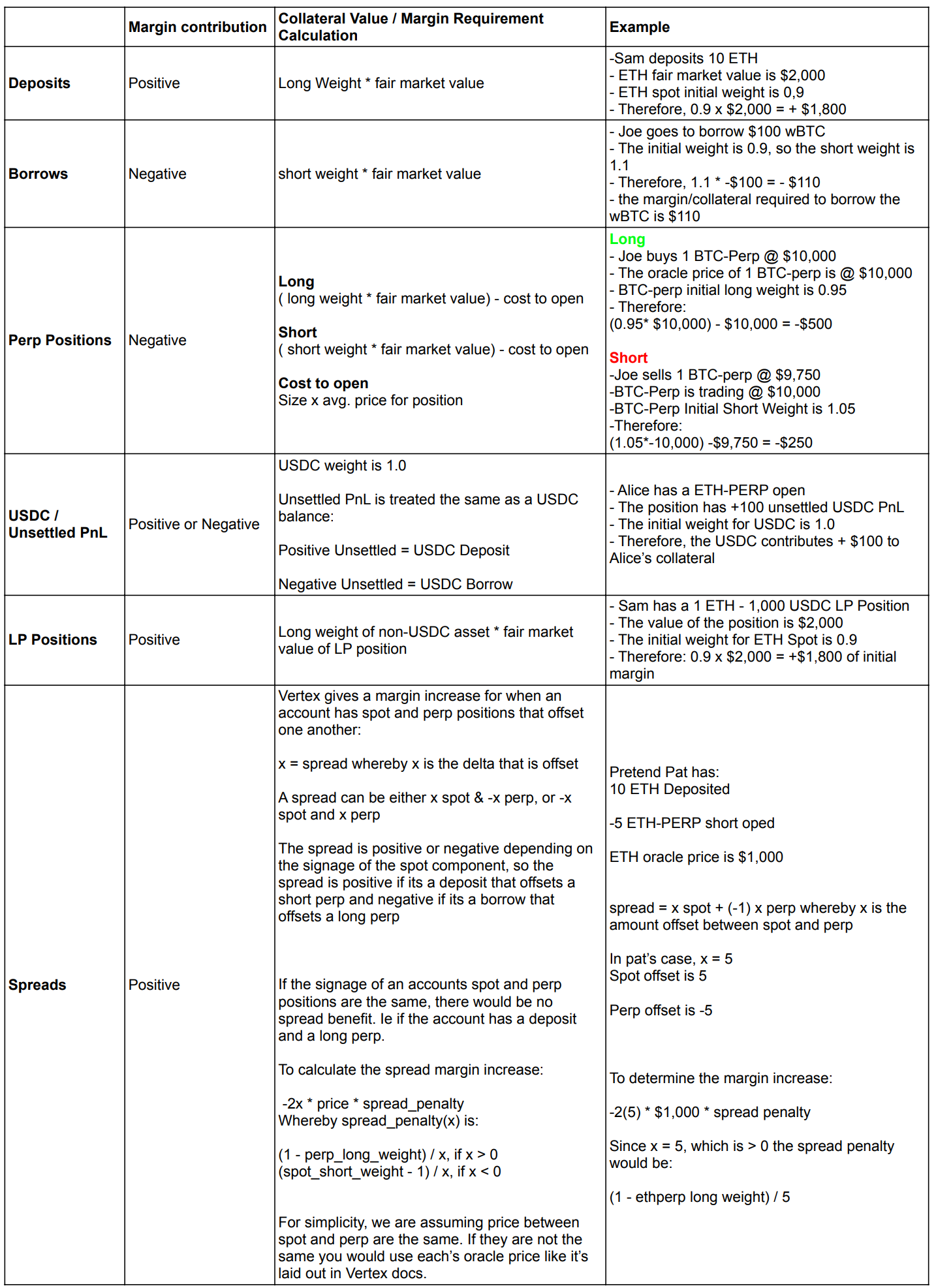

The table below covers the formulas Vertex used to determine the collateral value and margin requirements of different assets and liabilities. The initial and maintenance weights for each market can be found in the Vertex Docs.

Please note: for every market, there is a LONG and a SHORT weight. This is because assets are valued at a discount to their fair market value and liabilities at a premium. Fair market value is determined using the Oracle price feed.

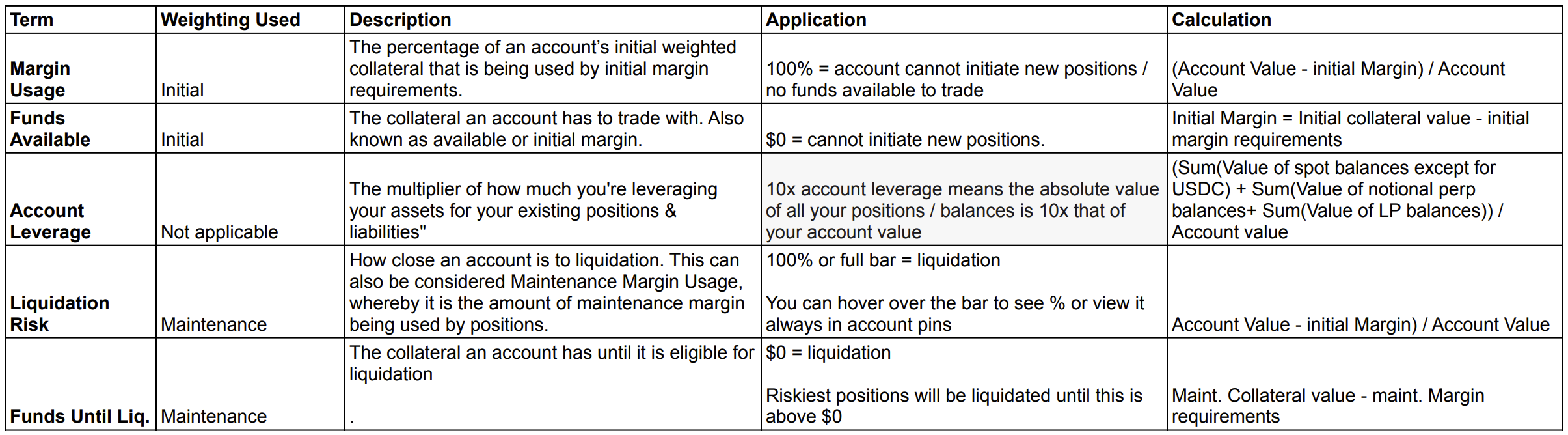

App Terms & Risk Info

Let’s bring it all together by examining the account information presented on the Vertex app. A screenshot of the Account Card on the new portfolio overview is displayed below. Inside the card, you’ll find all the information about your account. Terms will also be accessible in the Account Pins in the top navigation bar – below the trading console.

A Note on Isolated Margin

Vertex’s goal is to deliver the BEST trading experience. The opportunities afforded by Vertex’s current design are unique across DeFi, helping to differentiate and position Vertex from other exchange venues. That said, our team is aware that traders may also want to use isolated margin at times. Vertex will aim to add support for Isolated margin trading in the future. In the meantime, our team will continue to educate and empower traders to make efficient use of the distinctively unique tools Vertex offers.