Introducing the Vertex LBA – The Auction

Vertex is excited to share the upcoming plans for the VRTX token launch and liquidity bootstrapping auction (LBA)!

The LBA is designed to set a fair price for VRTX via organic demand from users. This post is the first in a series of tutorials where we’ll cover everything you need to know to participate in the Vertex LBA.

In upcoming posts, we’ll go into more detail, providing users with user-flow visuals from the Vertex app alongside a refresher of the Vertex Tokenomics and what you can expect once the VRTX token officially launches.

TLDR: what do you need to know?

LBA Dates: November 13th → November 20th, 2023

- The LBA will run for 7 days to achieve a more gradual price discovery & help establish a fair market price for the VRTX token.

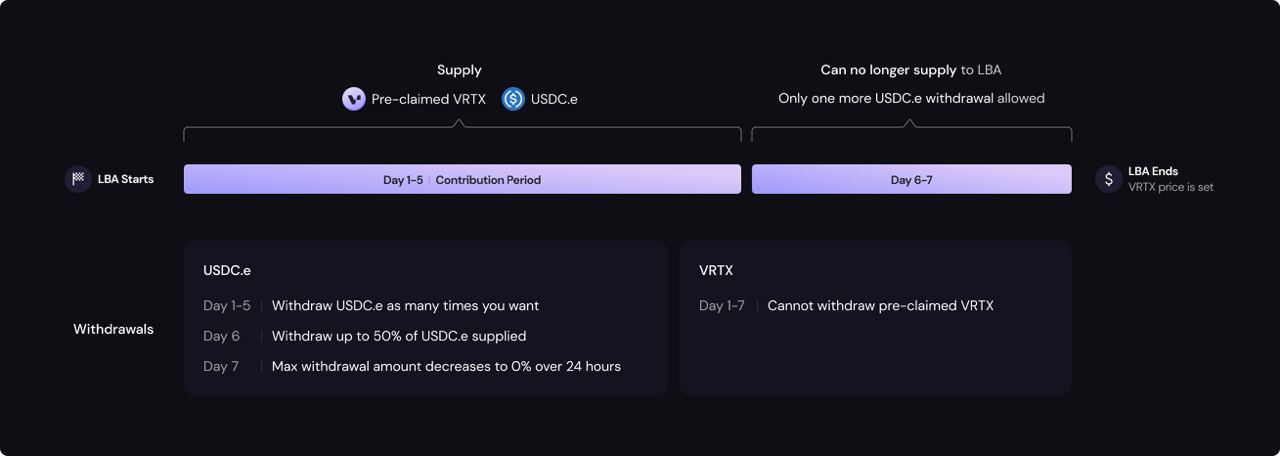

- Users will be able to supply $VRTX trading rewards and/or $USDC.e to the auction up until Day 5 of the auction.

- LP capital from the LBA will seed the initial VRTX-USDC.e pool on Vertex.

- 1% of token supply (10 million VRTX) is allocated as LP incentives for participants in the auction.

- LP capital supplied to the LBA will be locked and vested linearly over 120 days. In return, participating LPs will benefit from dual rewards composed of both pool fees and VRTX incentives.

What is the Vertex LBA?

The VRTX Liquidity Bootstrapping Auction (LBA) is the token genesis mechanism designed to seed the initial VRTX market liquidity while promoting fairness, lower sensitivity to price volatility, and more accessible capital requirements.

Unlike more conventional pool-based launches where the token price is fixed at launch, an LBA determines the price more organically over a prescribed period while maintaining several distinct properties.

Primarily, the characteristics that differentiate an LBA from more traditional pool-based token launches include:

- Elongated price discovery period utilizing a specific price curve.

- 2 Pool → 1 Pool model.

- LP token vesting and incentives.

The Vertex LBA provides anyone with the opportunity to get involved in the launch process, acquire VRTX, and earn rewards for participating.

Lastly, the conclusion of the 7-day auction will be immediately followed by the official VRTX token launch!

How can you participate, anon?

Let’s run through a high-level summary of how the LBA will unfold, focusing on how the auction works and considerations for users beforehand.

Stage 1: The Liquidity Bootstrapping Auction

When: 13:00 UTC on November 13th, 2023 → 13:00 UTC on November 20th, 2023

The Vertex LBA will occur over the course of 3 primary stages. Each stage has a unique purpose and mechanism.

- Stage 1: The 7-Day Auction

- Stage 2: VRTX Token Launch & Liquid Claiming

- Stage 3: Post-LBA Vesting & VRTX Tokenomics

The 7-Day Auction (Stage 1) is the topic of this post, which presents a summary of the most important phase where users can actively participate in the LBA. It’s where the VRTX price is determined gradually over the course of 7 days.

The VRTX Auction Design

The auction’s format in Stage 1 is simple. There are two pools:

- Pool 1 (USDC.e)

- Pool 2 (VRTX)

To participate in the LBA, users simply provide liquidity to either pool.

Both pools are single-sided liquidity pools, meaning you can only supply USDC.e to Pool 1 or VRTX to Pool 2.

Participating in the Vertex LBA means you are a liquidity provider (LP) to the auction.

Utilizing a fixed price curve (x * y = k), the implied price of the VRTX token is calculated via the final ratio between the collateral (USDC.e) & native token (VRTX) where:

After Day 7, the final VRTX price is the initial price of the token upon its launch, which will be the token price when Pools 1 & 2 are fused to create the VRTX-USDC.e pool on the Vertex AMM in Stage 2.

Who can participate in the LBA?

Anyone can participate in the LBA.

However, only Vertex users that have traded on the DEX before the LBA begins are eligible to supply liquidity to Pool 2 (VRTX). This is because users that traded on Vertex before the auction have pending VRTX rewards from the first 7 epochs of the Trade & Earn program.

If you have pending VRTX eligible for the LBA, your VRTX tokens are displayed on the “Rewards” page of the Vertex app. As a benefit to being an early Vertex user, you are eligible to supply liquidity to both Pool 1 (USDC.e) and Pool 2 (VRTX) – meaning you’re not strictly limited to one or the other.

Anyone can provide USDC.e liquidity to Pool 1 – meaning even if you’ve never traded on Vertex before the LBA, you can still participate in the auction. If you’re not familiar with the differences between USDC and USDC.e on Arbitrum, you can find more information in the Arbitrum documentation here.

In summary:

- Anyone: Provide USDC.e liquidity to Pool 1 – up until Day 5.

- Pre-LBA Vertex Traders: Provide USDC.e liquidity to Pool 1 and/or VRTX liquidity to Pool 2 – up until Day 5.

Why should you participate in the LBA?

LBA participants (i.e., LPs) are committing capital to the auction. Their LP capital is locked and vested linearly for 120 days starting after Day 7.

In return, LBA participants receive two compelling advantages:

- VRTX Fair Price: Users looking to gain exposure to VRTX have an opportunity to acquire the token at a fair-market price during the LBA as the virtual price is gradually achieved over 7 days.

- Dual Rewards: Users that LP one or both of the 2 Pools (VRTX & USDC.e) during the auction generate additional incentives, receiving dual rewards composed of:

- Pool Fees

- VRTX LP Incentives

The VRTX LP incentives consist of 1% of the VRTX token supply (10 million VRTX), specifically reserved for LBA participants.

Rewards are allocated to LPs of both pools – meaning everyone that participates in the auction earns dual rewards. The VRTX reward APRs are calculated pro-rata and based on trading fees relative to the total LP pool size.

You can find a table of APR projections at varying percentages of relative LP liquidity for Stage 1 auction participants below.

Distribution of VRTX incentives to LPs also occurs weekly – beginning after Day 7.

Weekly VRTX rewards are immediately claimable on the Vertex app once available for a given week, and distributions continue regularly each week throughout the entire 120-day vesting period.

LBA Stage 1: Reviewing the Auction Parameters

Duration: 7 Days

LP Contribution Period Ends: Day 5

Price Curve (Fixed): (x * y = k)

Pools: Two Single-Side Pools

- Pool 1 (USDC.e)

- Pool 2 (VRTX)

Eligible Participants:

- Anyone: Provide USDC.e liquidity to Pool 1 – up until Day 5.

- Pre-LBA Vertex Traders: Provide USDC.e liquidity to Pool 1 and/or VRTX liquidity to Pool 2 – up until Day 5.

LP Rewards: 1% of the total VRTX token supply (10 million VRTX).

Overview of Steps to Participate:

- Days 1 → 5: Supply USDC.e to Pool 1 and/or VRTX to Pool 2.

- Day 7 → April 20th, 2024: Generate and claim weekly VRTX rewards while also accruing pool fees in return for supplying capital to one or both pools during the auction (i.e., LPs).

- Post-LBA Vesting: LP capital supplied to Pool 1 and/or Pool 2 during the auction is locked and vested over the next 120 days. You can find more on the vesting schedule in the section below.

Lastly, if you would prefer to NOT participate in the LBA, you can simply wait until the end of Day 7 when the auction concludes and the VRTX token launches in Stage 2. For users with pending VRTX rewards, this means any VRTX that you do not pre-claim and supply to Pool 2 (VRTX).

We’ll cover the steps for pre-claiming VRTX trading rewards for the auction, along with some of the other available user actions on the Vertex app in the next post.

Post-LBA Vesting Schedule Primer

Any user that supplied liquidity to either Pool 1 (USDC.e) or Pool 2 (VRTX) during the auction in Stage 1 will have their LP positions locked and vested. You can find a visual graphic of the vesting schedule for LP capital that joined the LBA below.

Key Lock-Up & Vesting Details:

- ⅓ of LP liquidity from the auction will unlock 60 days after the end of the LBA.

- The remaining ⅔ of LP liquidity continues vesting linearly over the following 60 days, fully unlocking 120 days after the end of the LBA.

- Unlocked LP liquidity will still earn dual rewards if not withdrawn from the VRTX-USDC.e pool. The choice of whether to withdraw your unlocked auction liquidity or let it continue earning dual rewards is up to you.

- Users that withdraw vested LP capital will no longer earn dual pool fees + VRTX incentives on withdrawn portions of LP positions. Any remaining LP capital still vesting will still accrue dual rewards.

Example: Alice has VRTX trading rewards available before the LBA begins on November 13th. Alice chooses to supply VRTX liquidity to Pool 2 once the auction begins in Stage 1.

Alice’s LP Position for the Auction:

- Pool 2 (VRTX): Alice contributes 600 VRTX.

After 60 days pass from the conclusion of the auction, Alice can claim ⅓ of her total LP capital in full, immediately.

Since Alice supplied 600 VRTX to Pool 2 during the auction, Alice can claim 200 of her total 600 locked and vested VRTX on Day 60.

However, Alice does not have to withdraw her 200 VRTX LP capital yet.

If she prefers, Alice can leave her unlocked 200 VRTX as an LP position in the VRTX-USDC.e pool on the Vertex AMM, and she will still earn dual rewards composed of both pool fees and VRTX rewards.

Dual rewards generated on Alice’s 200 VRTX will continue until she either withdraws the unlocked VRTX or the vesting period ends on Day 120 in April 2024.

Note: Once the locked LBA liquidity fully vests in April 2024, the 10 million VRTX rewards allocated to LPs during the Stage 1 auction will be exhausted. Dual rewards will cease to generate for LP positions that participated in the LBA and remain as active LPs in the VRTX-USDC.e pool.

Stay tuned for more updates as we approach the LBA launch on November 20th! Next up in the series – navigating the Vertex app to participate in the Stage 1 auction.

If you have any questions about the LBA, Vertex in general, or want to get more involved in the community, then we invite you to:

Back to building. More on the way, anon.

~ Vertex Team

Vertex provides a decentralized protocol for trading spot digital currencies and perpetual contracts. Vertex is not authorised or regulated by the Financial Conduct Authority (FCA) or any other regulator. Since cryptocurrency markets are decentralised and non-regulated, our cryptocurrencies trading services are unregulated services which are not governed by any specific UK, European or other regulatory framework (including MIFID or MiCA). Therefore, when Vertex customers use our cryptocurrencies trading service, they will not benefit from the protections available to clients receiving regulated investment services.

Vertex customers using the cryptocurrencies trading service will not benefit from the protections available to clients receiving regulated investment services such as access to the Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service for dispute resolution. All of our products carry a high degree of risk and are not suitable for many investors. It is important that you fully understand the risks involved before deciding to trade with Vertex, that you have adequate financial resources to bear such risks and that you monitor your positions carefully. Trading involves risk to your capital. You should not invest money that you cannot afford to lose. You should seek professional advice if you do not fully understand and accept the risks of investing in the products offered by Vertex. You should review our Statement of Risk before investing.