Introducing: Margin Manager

At Vertex, we aim to bring traders the most powerful trading experience. Vertex’s cross-margin framework equipped with spot, perp, and money markets makes it a truly unique venue for trading and risk management. We also seek to make Vertex accessible and usable. It is with this in mind that we have designed and developed the Margin Manager.

What is the Margin Manager?

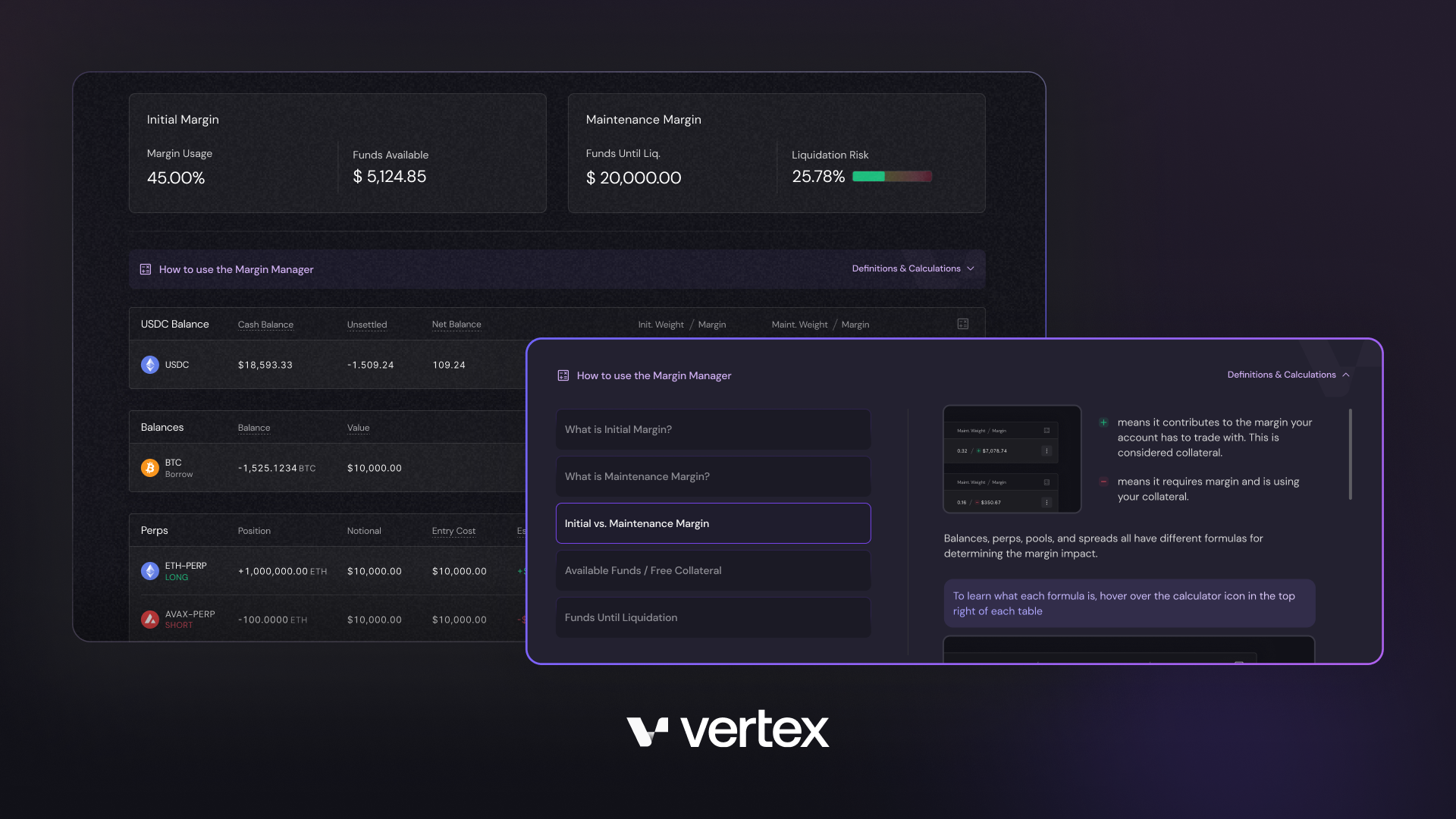

The Margin Manager is a new addition to the app to make trading on Vertex an even better, more powerful experience. It is a page within the Portfolio section of the app and empowers traders to make the most of Vertex’s cross-margin design.

The Margin Manager is a tool that lets you see all of your account’s balances and positions in one place, and the impact they have on your margin.

- See your USDC balance along with any other deposits or borrows

- See your Perp, LP, and Spread (NEW) Positions

- See how everything above either contributes to your collateral or uses up margin

- Understand how everything is calculated and given a value within Vertex

- Make quick actions to manage your account

The Margin Manager is objective.

Its purpose is to give you the information you need to understand what is going on with your account and make decisions as you see fit. The totals give you a picture of your account’s trading abilities and risk, while the tables show you where those totals are coming from.

How to use the Margin Manager (Tutorial)

It might seem like there is a lot going on at first, but the Margin Manager is actually quite easy to use. Below we lay out the steps for making the most out of this tool.

You can also learn how to use the Margin Manager and all the terms by opening the purple “How to use the Margin Manager” tab on the page.

(1) Accessing the Margin Manager

-> Go to Portfolio

-> Use the sub-navigation to select Margin Manager

(on the left hand side for Desktop, top for mobile)

(2) Understanding the Terms

At the top of the Margin Manager page you will see your account’s margin totals. This is broken down into Initial and Maintenance related values:

Initial Margin

- Available Funds - this represents the amount of margin you have available to initiate new positions. Also known as free collateral on some platforms, it is the sum of all the Initial Margin columns in the tables below.

- Margin Usage - this is how much of your total initial weighted margin is being used.

Both these terms represent your Initial Margin in a different way, whereby $0.00 Available Funds = 100% Margin Usage.

Maintenance Margin

- Funds Until Liq. - This represents the amount of margin you have until your account can started being liquidated. You must maintain above $0 and it is the sum of all the Maintenance Margin columns in the tables below.

- Liquidation Risk - This is how much of your total maintenance weighted margin is being used and it represents how close you are to liquidation on a 0-100% scale, with 100% being liquidated. It could also be known as Maintenance Margin Usage.

Both these terms represent your Maintenance Margin in a different way, whereby $0.00 Funds Until Liq. = 100% Liq Risk

(3) The Tables & Impact on Margin

The Margin Manager gives you an overview of everything going on with your Vertex account. The tables display all of your balances, positions, and the impact they have on your margin.

-> Any balance or position you have will be displayed in the tables

-> It will show you the high level information, such as the size and value

UNIQUE to Margin Manager is the 2 most far right columns:

- Initial Weight / Margin column: here you will find the initial weight given to the balance or position and it’s impact on your initial margin.

- Maint. Weight / Margin column: here you will find the maintenance weight given to the balance or position and it’s impact on your maintenance margin.

The margin part will have a [+] or [-]

[+] = means the balance or position contributes to the margin your account has. This is collateral.

[-] = means it requires margin and is using your collateral.

(4) Understanding the Calculations Behind the Margin Imact

-> In the top right corner of each table you will find a little calculator icon

-> Hover over the icon

-> A tooltip will appear displaying the calculation used to determine the margin impact

Balances, perps, pools, and spreads all have different formulas for determining margin impact. There is also a long and short weight for each. To learn more about product specifications and weights, please refer to The Docs.

UNIQUE to Margin Manager - Spreads

The Margin Manager is the first part of the Vertex App that displays the spread positions you have. Spread positions occur when you have a balance and a perp position that offset one another. A margin benefit is given to spread positions due to the decreased exposure an account has to that market. For example: a deposit of wBTC and a short of BTC-PERP. Or the opposite; a wBTC borrow and a long BTC-PERP position. The size of the spread is the amount that has been offset. So if you have a 5 wBTC deposit and short 10 BTC-PERP, the spread size would be 5 BTC worth.

(5) Account Management & Shortcuts

So now that you know how to navigate the Margin Manager, how do I use it?

The Margin Manager is ultimately an objective tool for you to use as you like;

- Understand your account’s ability to trade/open new positions,

- Check your account’s risk of liquidation and what’s causing it,

- Quickly manage your balances and positions via shortcuts,

- Or, simply visualize everything that is going on within your account in one place

Action Shortcuts

-> To the right of each table you will find the actions associated with that balance or position

-> For USDC and other deposits/borrows, the 3 dot drop down let’s you deposit, withdraw, borrow, and repay

-> for Perps you can quickly close positions

-> for Pools you can provide or withdraw liquidity

-> for Spreads you can trade the spot or perp position

We hope you enjoy using the Margin Manager.

As always, if you have any questions or ideas - please create a support ticket or reach out to a team member in Discord.

👉 Start Trading 👉 Follow Vertex on Twitter