Announcing Stops Orders - The First of New Order Types Coming To Vertex

Introducing the first stop order type and a tutorial on how to use them.

At Vertex, we’re in pursuit of the ultimate trading experience. No exceptions.

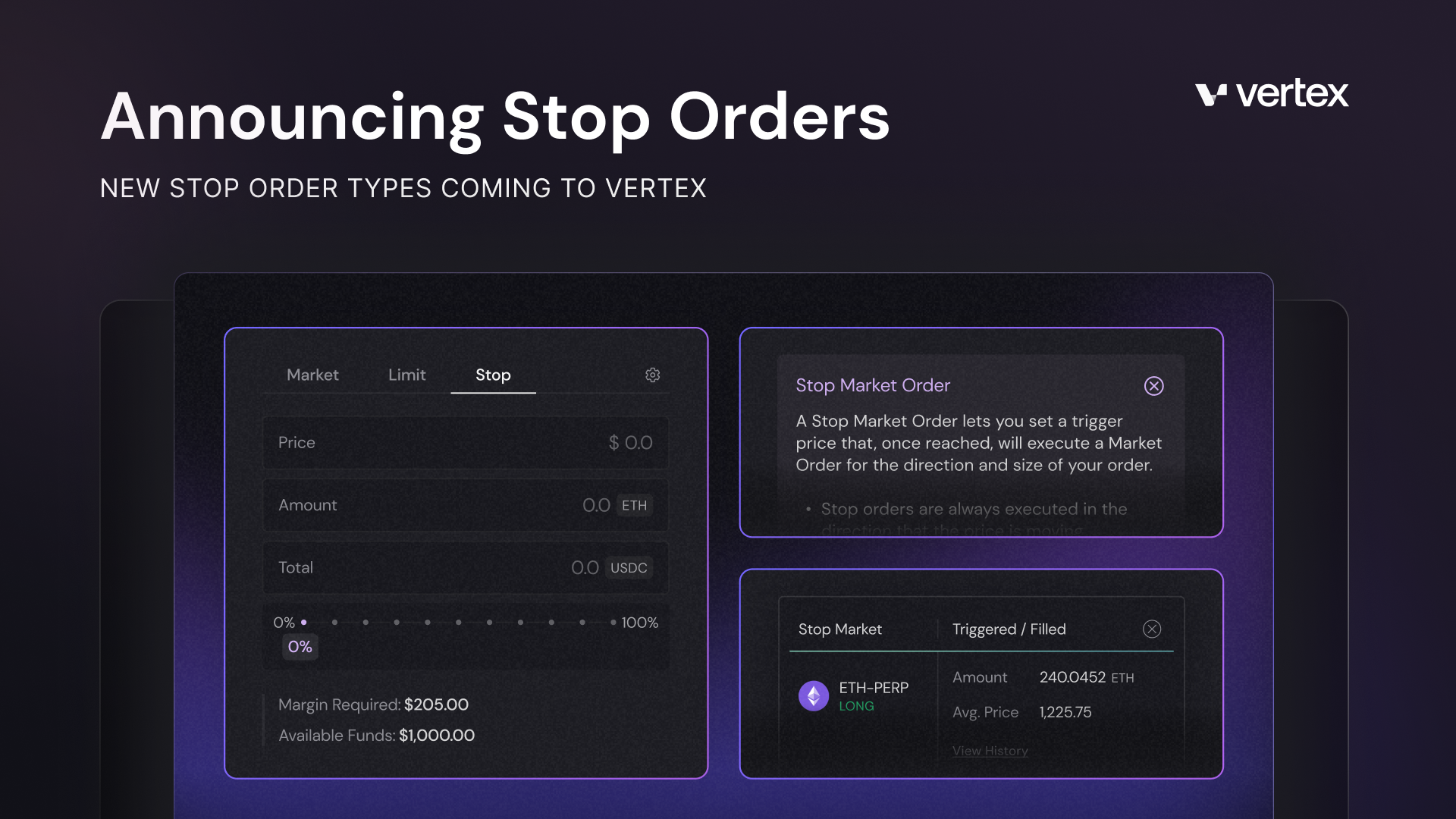

We’re excited to share that Vertex will soon support stop-order types, with the first being a stop-market. Order types and risk management for positions have been a focus area of feature development, and we are pleased to start rolling these features out over the coming weeks.

What is a stop market order?

A stop-market lets you set a trigger price that, once reached, will execute a market order. Stop orders can be used to close existing positions (stop-loss) or to open new positions(stop-entry).

What is a stop-market not?

Stop-market orders are NOT conditional / linked to a position or order. Stop-market orders must be managed as individual orders. Let’s look at an example:

- Sam is long 100 ETH-PERP @ $2200

- Sam places a stop-market sell order for 100 ETH-PERP with a trigger price of $2000

- The trigger price is never reached

- Sam market sells 100 ETH-PERP @ $2300

In this scenario, Sam’s stop-market sell order will continue to exist. Sam must cancel the stop-market order manually. If Sam doesn’t cancel the order and ETH-PERP trades down to $2000, Sam could end up in an unwanted short position.

Please take care to cancel unwanted stop-market orders as you close and open positions.

What is needed to place and maintain a stop market order? - 1 Click Trading

You’ll need to have One-Click Trading (1CT) enabled to use stops. Stop orders place an order on your behalf once the trigger price is reached, which is made possible through 1CT.

Please note that if you have existing stop orders and disable/turn off 1CT, they will be cancelled.

Important Information About Market Orders

Market orders are Fill-or-Kill (FoK), meaning that if the order doesn’t fill entirely, it will be killed (no partial fills). Slippage for stop market orders is set at 10% and not adjustable. The preset percent is designed to reduce risk of users forgetting to adjust for a stop. While this pre-set range should be sufficient enough for orders to fill, Vertex cannot guarantee a successful stop order as it is dependent on market conditions and circumstances that do not permit the order to fill.

Future Order Types - Conditional (linked) take-profit / stop-loss and stop-limit orders

This is a common feature request and a useful tool for many users’ positions and risk management.

After the initial launch of stop-market orders, the Vertex team will focus on enabling linked orders that will help support a familiar TP & SL experience, connecting orders to existing positions. Additionally, Vertex will eventually support stop limits that trigger limits rather than market orders, allowing traders greater control over execution..

How to place a stop market order (tutorial)

Step 1: Select Stop as your order type

- This is the order type to the right of Limit

Step 2: Enter your trade details

- Trigger price will define the level where a market order is placed.

Step 3: Place the order

Step 4: Manage your order

- Navigate to any of the tables that display open orders on Vertex: on trading pages and in the Open Orders subpage in the portfolio

- View your existing orders and easily cancel them or all

REMEMBER to cancel any unwanted stop orders when closing and opening positions.